The Chancellor has delivered his third Budget, coming at a time where there is continued uncertainty over the impact of Brexit negotiations, declaring ‘austerity finally coming to an end’.

There were few announcements specifically for the construction sector, however notably, Mr Hammond has called time on PFI, saying the government will honour existing PFI and PF2 deals but will not fund further schemes.

The construction sector will welcome confirmation of a £28.8 billion National Roads Fund, which includes £25.3 billion in funding and a pipeline of projects for Highways England’s second Road Investment Strategy (RIS2) from 2020 to 2025. Additionally £420 million has been allocated to local authorities in 2018/19 to tackle potholes and renew bridges and tunnels.

A further £8.7 billion has been set aside for the Help to Buy equity loan as the scheme has been extended for two years to March 2023 but from April 2021, eligibility will be narrowed to first-time buyers and new regional price caps introduced. The Chancellor also introduced a £675 million Future High Streets Fund for town centre infrastructure investment, alongside a consultation on planning flexibility for change of use to residential and permitted development rights.

Other content relevant to construction product manufacturers and distributors include:

- The National Productivity Investment Fund (NPIF) has been increased from £31 billion to £37 billion and extended to 2023/24, including a £500 million increase in the Housing Infrastructure Fund to £5.5 billion

- Carbon price support (CPS) – The price of EU Emissions Trading System (ETS) allowances has risen significantly over recent months, raising the Total Carbon Price (currently made up of the EU ETS price and the CPS rate). The government will freeze the CPS rate at £18/t CO2 for 2020/21. From 2021/22, the government will seek to reduce the CPS rate if the Total Carbon Price remains high

- A tax on the production and import of plastic packaging will be introduced from April 2022. Subject to consultation, this tax will apply to plastic packaging which does not contain at least 30% recycled plastic.

Economic and Fiscal Overview

The Office for Budget Responsibility (OBR) has published its latest forecasts on the economic and fiscal outlook.

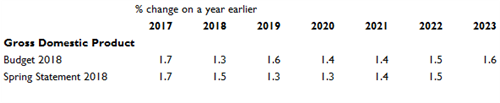

The OBR has revised down its UK GDP growth forecast for 2018 to 1.3% from 1.5% previously anticipated in the March forecast, due to adverse weather conditions in the first quarter of the year. Looking ahead, the OBR expects growth to pick up to 1.6% in 2019, an upward revision from 1.3% previously forecast in March, as the impact of the discretionary fiscal loosening in the Autumn Budget boosts activity, before growth of 1.4% in 2020. These forecasts assume a two-year Brexit transition period from March 2019. The OBR left its GDP growth forecasts for 2021 and 2022 unchanged at 1.4% and 1.5% respectively, whilst projected growth of 1.6% for 2023. The stronger growth in the latter years of the forecast period reflects an improvement in productivity growth.

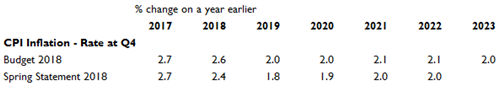

The OBR has upgraded its inflation expectations for the next five years. Following an upwardly revised figure of 2.6% for 2018, CPI inflation is expected to fall towards the Bank of England’s 2.0% target in the near-term as the impact of higher oil prices diminishes and as a result of policy measures on duties and energy prices. In 2019, inflation is forecast at 2.0%, an upward revision from 1.8% previously anticipated in the March publication. Thereafter, inflation is forecast at 2.0% in 2020, up from 1.9% projected in March. In both 2021 and 2022, inflation is projected at 2.1%, an upward revision from 2.0% previously projected, before easing to 2.0% in 2023. Overall, the medium-term forecasts show that CPI inflation is expected to remain slightly above the Bank’s 2.0% target due to the economy operating slightly above potential.

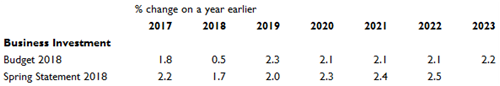

Business investment is forecast to increase 0.5% in 2018, a downward revision from the 1.7% growth anticipated in March, reflecting the impact of Brexit-related uncertainty. Looking ahead however, business investment is forecast to increase 2.3%, up from 2.0% predicted in the previous OBR outlook. Thereafter, business investment is projected to increase 2.1% per year between 2020 and 2022, before rising by 2.2% in 2023. The OBR stated that growth in the near-term is predicated on a successful deal with the EU and a two-year transition period, which should encourage investment. However, it added that uncertainty is likely to persist going forward and, as a result, any investment pick-up is likely to be limited.

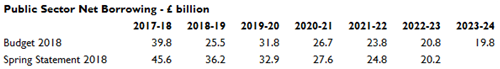

Public sector net borrowing is estimated to have totalled £39.8 billion during the 2017/18 financial year, a downward revision from £45.6 billion expected in the March forecast, due lower-than-anticipated public spending. Similarly, the OBR has lowered its forecast for 2018/19, with public sector net borrowing now forecast to fall to £25.5 billion, down from £36.2 billion previously expected, owing to strong and broad-based tax receipts growth. Thereafter, public sector net borrowing is forecast to increase in 2019/20 due to NHS spending and tax adjustments, before falling each year between 2020/21 and 2023/24. Total public sector net debt as a percentage of GDP is expected at 83.7% in 2018/19, down from 86.4 % in the March publication, reflecting the reclassification of Scottish and Welsh housing associations to the private sector, as well as downward revisions to the PSNB forecast. Thereafter, public sector net debt as a percentage of GDP is projected to decline each year, reaching 74.1% in 2023/24.

Industry and sector policies

The government made a series of new announcements relevant to businesses and industry. These include:

Housing

- The Help to Buy equity loan has been extended for two years to March 2023. From April 2021, eligibility will be narrowed to first-time buyers and new regional price caps introduced, set at 1.5 times the current forecast regional average first-time buyer price

- The Housing Infrastructure Fund will be increased by £500 million to £5.5 billion, which aims to unlock sites covering 650,000 new homes

- The final report from the Letwin Independent Review of Build Out was published alongside the Budget. It recommends a new planning framework for large sites (above 1,500 units) to allow for greater differentiation in the types and tenures of housing delivered on these sites, to increase the market absorption rates of new homes, which is judged as the key determinant of build out rates for housing. The government will respond in February 2019

- A £675 million Future High Streets Fund was introduced for town centre infrastructure investment, alongside a consultation on planning flexibility for change of use to residential and permitted development rights to allow upwards extensions above commercial premises and residential properties, and to allow commercial buildings to be demolished and replaced with homes

- The British Business Bank will deliver a new scheme providing guarantees to support up to £1 billion of lending to SME housebuilders

- £653 million will be provided to 2021/22 for strategic partnerships with nine housing associations to deliver over 13,000 homes

- The government will provide £8.5 million of resource support so that up to 500 parishes can allocate or permission land for homes sold at a discount. This forms part of the Localism Act and provides financial support for an estimated 500 neighbourhood plans

- First-time buyer relief on stamp duty in England and Northern Ireland will be extended to shared ownership property purchases below £500,000. This change will apply to relevant transactions from 29 October 2018, but will also be backdated to 22 November 2017

- A consultation will be launched in January 2019 on a stamp duty surcharge of 1% for non-residents buying residential property in England and Northern Ireland

- The government is launching a call for evidence inviting proposals from private sector investors willing to collaborate with government to deliver a new wave of shared ownership homes

- The government confirmed the Housing Revenue Account cap that controls local authority borrowing for house building will be abolished from 29 October 2018 in England, with an aim of providing 10,000 homes per year. The cap will also apply in Wales

- £10 million capacity funding will be available to support housing deals with authorities in areas of high housing demand to deliver above their Local Housing Need

- The system of developer contributions will be simplified to provide more certainty for developers and local authorities, while enabling local areas to capture a greater share of uplift in land values for infrastructure and affordable housing. The reforms include simplifying the process for setting a higher zonal Community Infrastructure Levy in areas of high land value uplift, and removing all restrictions on Section 106 pooling towards a single piece of infrastructure. The government will also introduce a Strategic Infrastructure Tariff for Combined Authorities and joint planning committees with strategic planning powers

National and Regional Infrastructure

- The government announced the ring-fencing of English vehicle excise duty for roads spending to provide a £28.8 billion National Roads Fund. This includes £25.3 billion funding for Highways England’s second Road Investment Strategy (RIS2) from 2020 to 2025

- The government allocated £420 million to local authorities in 2018/19 to repair potholes and renew bridges and tunnels. £150 million of NPIF funding will also be made available to local authorities for small congestion-related improvement projects such as roundabouts.

- As part of the NPIF, the government is extending the Transforming Cities Fund by a year to 2022/23. This will provide an extra £240 million to the six metro mayors for significant transport investment in their areas: £21 million for Cambridgeshire and Peterborough, £69.5 million for Greater Manchester, £38.5 million for Liverpool City Region, £23 million for West of England, £71.5 million for the West Midlands, and £16.5 million for Tees Valley. In addition, a further £440 million will be made available to the city regions shortlisted for competitive funding.

- £200 million is allocated from the NPIF to pilot innovative approaches to deploying full fibre internet in rural locations, starting with primary schools, and with a voucher scheme for homes and businesses nearby. The first wave of this will include the Borderlands, Cornwall, and the Welsh Valleys. In addition, Suffolk is the first local area to be awarded £5.9 million of funding from the third wave of the Local Full Fibre Networks challenge fund, enabling next-generation full fibre connections to key public buildings.

- A National Infrastructure Strategy that will be published in 2019, in response to the National Infrastructure Commission’s (NIC) ‘National Infrastructure Assessment’ published in July. A new NIC study, to be published in Spring 2020, will report on how to improve the resilience of the UK’s infrastructure in light of technological advances and future challenges such as climate change

- The Budget announces up to a further £37 million to support the development of Northern Powerhouse Rail, adding to the £300 million already committed to ensure HS2 infrastructure can accommodate future potential Northern Powerhouse Rail and Midlands Engine Rail services

- The government is providing a further £20 million to develop a strategic outline business case and routes for the East West rail link between Cambridge and Bedford

Policy, taxes and levies

- Government will no longer use PFI and its successor PF2, which has not been used since 2016. There remain 716 existing PFI/PF2 contracts in place that will continue

- Fuel duty will be frozen for a ninth successive year

- From 1 April 2019 vehicle excise duty rates for cars, vans and motorcycles will increase in line with RPI. To support the haulage sector, the government will freeze the Heavy Goods Vehicle (HGV) duty for 2019/20

- The price of EU Emissions Trading System (ETS) allowances has risen significantly over recent months, raising the Total Carbon Price (currently made up of the EU ETS price and the CPS rate). The government will freeze the CPS rate at £18/t CO2 for 2020/21. From 2021/22, the government will seek to reduce the CPS rate if the Total Carbon Price remains high

- In the event of ‘No Deal’ and the UK departs from the EU ETS in 2019, government would introduce a Carbon Emissions Tax. The tax would apply to all participating in the EU ETS from 1 April 2019. A rate of £16/t would apply over and above an installation’s emissions allowance, based on free allowances under the EU ETS.

- The Climate Change Levy (CCL) electricity rate will be lowered in 2020-21 and 2021-22. The gas rate will increase in 2020-21 and 2021-22 so it reaches 60% of the electricity main rate by 2021-22. Other fuels, such as coal, will continue to align with the gas rate. The discount for sectors with Climate Change Agreements will change to reflect the change in CCL main rates

- The government will provide the British Business Bank with up to £200 million of additional investment in the UK to compensate for the loss of European Investment Bank (EIB) funding. However, this equates to only 10.5% of EIB total investment in the UK in 2017.

- The government will freeze Aggregates Levy rates for 2019-20 at £2 per tonne in 2019/20 but it intends to return the Levy to index-linking in future

- The VAT threshold will therefore be maintained at the current level of £85,000 for a further 2 years until April 2022. The government will look again at the possibility of introducing a smoothing mechanism once the terms of EU exit are clear

- The government will reduce business rates by one-third for small retail properties (with a rateable value below £51,000) for 2 years from April 2019

- The government will introduce a VAT domestic reverse charge to prevent VAT losses through ‘Missing Trader’ fraud from 1 October 2019

- National Living Wage (NLW) and National Minimum Wage (NMW) – The government’s objective is for the NLW to reach 60% of median earnings by 2020, subject to sustained economic growth. The government will increase the NLW by 4.9% from £7.83 to £8.21 from April 2019. From April 2019, the other NMW rates will rise:

- from £7.38 to £7.70 per hour for 21 to 24 year olds

- from £5.90 to £6.15 per hour for 18 to 20 year olds

- from £4.20 to £4.35 per hour for 16 to 17 year olds

- from £3.70 to £3.90 per hour for apprentices

- The Budget confirmed that the government will make up to £450 million available to enable apprenticeship levy paying employers to transfer up to 25% of their funds to pay for apprenticeship training in their supply chains

- The government will provide up to £240 million, to halve the co-investment rate for apprenticeship training to 5%

- Up to £5 million will be allocated to the Institute for Apprenticeships and National Apprenticeship Service in 2019/20, to identify gaps in the training provider market and increase the number of employer-designed apprenticeship standards available to employers. All new apprentices will start on these new, higher-quality courses from September 2020

- The Budget allocates £100 million for the first phase of the National Retraining Scheme (NRS). This will include a new careers guidance service to help people identify work opportunities in their area, and courses combining online learning with traditional classroom teaching to develop key transferable skills.

- The government will temporarily increase the Annual Investment Allowance to £1 million for all qualifying investment in plant and machinery made on or after 1 January 2019 until 31 December 2020

- New non-residential structures and buildings will be eligible for a 2% capital allowance (Structures and Buildings Allowance) where all the contracts for the physical construction works are entered into on or after 29 October 2018. HMRC has published a technical note on the allowance.

- From April 2019, the capital allowances special rate for qualifying plant and machinery assets will be reduced from 8% to 6% to more closely match average accounts depreciation

- Government will introduce a tax on the production and import of plastic packaging from April 2022. Subject to consultation, this tax will apply to plastic packaging which does not contain at least 30% recycled plastic, to transform financial incentives for manufacturers to produce more sustainable packaging.