Against a backdrop of slowing economic growth, and continued uncertainty over the shape Brexit, the Chancellor delivered his first Autumn Budget promising a forward-looking economy on a new path with its European neighbours.

The Office for Budget Responsibility provided a downgrade on the projected growth rate for 2017, blaming it on weak productivity. The OBR cut growth forecasts from 2% to 1.5%, and for 2021 instead of the projected 2.0% the economy is expected to grow 1.5%.

The headlines were saved for housing with the Chancellor announcing that as of today, he is abolishing the stamp duty charge for first time homebuyers for properties up to £300,000, and on the first £300,000 of the purchase price of properties up to £500,000. The Chancellor also committed £44 billion of capital funding, loans and guarantees, including an additional £15.3 billion in new measures, to allow the delivery of 300,000 net additional homes per year by the mid-2020s, compared to 217,000 in 2016/17. To ensure a workforce is able to deliver these homes, an additional £34 million was promised to develop construction skills across the country.

On the construction sector in general, the government’s long-term ambition of increasing R&D investment will see £170 million for innovation to transform productivity in the construction sector. The government also reaffirmed the steps being taken to improve infrastructure delivery, and has promised to use its purchasing power to drive adoption of modern methods of construction, such as offsite manufacturing. Furthermore, the Infrastructure and Projects Authority will publish an update to the National Infrastructure and Construction Pipeline in December 2017, setting out a 10 year projection of public and private investment in infrastructure of around £600 billion.

Other content relevant to construction product manufacturers and distributors include:

- The government is working with industry to finalise a Construction Sector Deal that will support innovation and skills in the sector, including £170 million of investment through the Industrial Strategy Challenge Fund.

- The Budget commits a further £2.7 billion to the competitively-allocated Housing Infrastructure Fund (HIF) in England. This takes the total investment in the HIF to £5 billion.

- A £1.7 billion Transforming Cities Fund to improve local transport connections and £385 million for projects to develop next generation 5G mobile and full-fibre broadband networks, both funded from the NPIF.

- For business rates, the government will bring forward to 1 April 2018 the planned switch in indexation from RPI to the main measure of inflation (currently CPI).

Economic and Fiscal Overview

The Office for Budget Responsibility (OBR) has published its latest forecasts on the economic and fiscal outlook.

http://cdn.budgetresponsibility.org.uk/Nov2017EFOwebversion.pdf

The OBR has revised down its UK GDP growth forecasts for the next four years, reflecting a significant downward revision to its forecast for productivity growth and weaker business investment. The OBR now expects the UK economy to grow 1.5% in 2017 and 1.4% in 2018, a downward revision from 2.0% and 1.6% respectively, forecast in the March outlook. Furthermore, GDP growth for 2019 has been downgraded to 1.3% from 1.7% projected previously, as public spending cuts intensify and Brexit-related uncertainty continues to weigh on activity. In 2020, growth is expected to remain at 1.3%, before rising to 1.5% in 2021 and 1.6% in 2022, underpinned by a modest improvement in productivity growth.

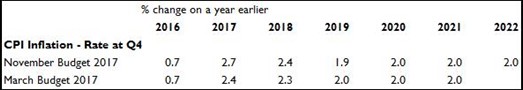

Inflation expectations have been revised up for 2017 by 0.3 percentage points. Inflation is forecast at 2.7% for 2017, up from 2.4% anticipated in the March publication, reflecting the impact of the past Sterling’s depreciation on import prices and rising global commodity prices. However, as these effects begin to fade, the annual rate of inflation is expected to ease in the subsequent two years. In 2018 and 2019, inflation is forecast at 2.4% and 1.9%, compared to rates of 2.3% and 2.0% respectively, predicted in March. Looking ahead, the OBR projects CPI inflation to remain steady at the Bank of England’s 2.0% target each year between 2020 and 2022, unchanged from its previous forecasts.

Business investment is forecast to increase 2.5% in 2017, an upward revision from the 0.1% fall anticipated in March, due to ONS data revisions. In both 2018 and 2019, business investment is forecast to increase 2.3%, a downward revision from rate of 3.7% and 4.2% predicted in the previous OBR outlook. Overall, business investment is expected to remain subdued in the near-term, as ongoing Brexit-related uncertainty continues to dent activity. Business investment is projected to increase 2.4% each year between 2020 and 2022.

Public sector net borrowing is estimated to have totalled £49.9 billion during the 2017/18 financial year, a downward revision from £58.3 billion expected in the March Budget. Thereafter, public sector net borrowing is forecast to fall each year between 2018/19 and 2022/23, but will fall by £23.8 billion less between 2017/18 and 2021/22 than in the March forecast due to lower productivity growth reducing tax receipts. Total public sector net debt as a percentage of GDP is expected at 86.5% in 2017/18, down from 88.8% in the March Budget, reflecting the reclassification of English housing associations to the private sector. Thereafter, public sector net debt as a percentage of GDP is projected to decline each year, reaching 79.3% in 2021/22.

Industry and sector policies

The government made a series of new announcements relevant to businesses and industry. These include:

Skills and R&D

- The government is working with industry to finalise a Construction Sector Deal that will support innovation and skills in the sector, including £170 million of investment through the Industrial Strategy Challenge Fund.

- The government is taking a series of steps to improve the cost effectiveness, productivity and timeliness of infrastructure delivery. The government will use its purchasing power to drive adoption of modern methods of construction, such as offsite manufacturing. Building on progress made to date, the Department for Transport, the Department of Health, the Department for Education, the Ministry of Justice, and the Ministry of Defence will adopt a presumption in favour of offsite construction by 2019 across suitable capital programmes, where it represents best value for money.

- The government will establish a partnership between employers, the Trades Union Congress and the Confederation of British Industry, to develop the National Retraining Scheme. Together they will help set the strategic priorities for the scheme and oversee its implementation, working with new Skills Advisory Panels to ensure that local economies’ needs are reflected.

- As a first step, the National Retraining Partnership will oversee targeted short-term action in sectors with skills shortages, initially focussing on construction and digital skills. The government will support the construction industry to help ensure that there is a workforce fit to build 300,000 homes, providing £34 million to scale up innovative training models across the country, including a programme in the West Midlands. Construction skills will also be a focus for the National Retraining Scheme.

- The government announced T levels at Spring Budget 2017. As implementation gets underway, the government will invest up to £20 million to help teachers and further education colleges prepare for this change.

- The government will continue to work with employers on how the apprenticeship levy can be spent so that the levy works effectively and flexibly for industry, and supports productivity across the country.

- The Budget invests a further £2.3 billion in R&D in 2021/22 from the NPIF, and increases the R&D expenditure credit to 12%, towards the government’s ambition to raise the level of investment in R&D in the economy to 2.4% of GDP.

Housing

- The government is making available £15.3 billion of new financial support for housing over the next five years, bringing total support for housing to at least £44 billion over parliament.

- The government will permanently raise the price at which a property becomes liable for stamp duty land tax (SDLT) to £300,000 for first‑time buyers to help young people buy their first home. The relief will not apply for purchases of properties worth over £500,000. 95% of first‑time buyers that pay SDLT will benefit, up to a maximum of £5,000, and 80% of first‑time buyers will pay no SDLT at all.

- The government is keen to encourage owners of empty homes to bring their properties back into use. To help achieve this, local authorities will be able to increase the council tax premium from 50% to 100%.

- The government will consult on a new policy whereby local authorities will be expected to permission land outside their plan on the condition that a high proportion of the homes are offered for discounted sale for first‑time buyers, or for affordable rent. This will exclude land in the Green Belt.

- The government will provide £1.1 billion for a new Land Assembly Fund, funded from the NPIF. The new fund will enable Homes England to work alongside private developers to develop strategic sites, including new settlements and urban regeneration schemes.

- The government will bring together public and private capital to build five new garden towns, using appropriate delivery vehicles such as development corporations, including in areas of high demand such as the South East.

- The Budget commits a further £2.7 billion to the competitively-allocated Housing Infrastructure Fund (HIF) in England. This takes the total investment in the HIF to £5 billion.

- The government will provide a further £630 million through the NPIF to accelerate the building of homes on small, stalled sites, by funding on‑site infrastructure and land remediation.

- The Budget announces a further £1.5 billion for the Home Building Fund, providing loans specifically targeted at supporting SMEs who cannot access the finance they need to build.

- The government will explore options with industry to create £8 billion worth of new guarantees to support housebuilding, including SMEs and purpose built rented housing (Build to Rent).

National and Regional Infrastructure

- The Infrastructure and Projects Authority will publish an update to the National Infrastructure and Construction Pipeline in December 2017. This will set out a 10-year projection of public and private investment in infrastructure of around £600 billion.

- £300 million will be spent on ensuring High Speed 2 (HS2) infrastructure can accommodate future Northern Powerhouse and Midlands rail services. Transport for the North and Midlands Connect are working up the case for these services. This will enable faster services between Liverpool and Manchester, Sheffield, Leeds and York, as well as to Leicester and other places in the East Midlands and London.

- Budget announces a £1.7 billion Transforming Cities Fund to improve local transport connections and commits £385 million to projects to develop next generation 5G mobile and full-fibre broadband networks, both funded from the NPIF. It will target projects which drive productivity by improving connectivity, reducing congestion and utilising new mobility services and technology. Half will be allocated via competition for transport projects in cities and the other half will be allocated on a per capita basis to the 6 combined authorities with elected metro mayors – £74 million for Cambridgeshire and Peterborough, £243 million for Greater Manchester, £134 million for Liverpool City Region, £80 million for West of England, £250 million for West Midlands and £59 million for Tees Valley – enabling them to invest in their transport priorities.

- The government is launching a new £190 million Challenge Fund that local areas around the country will bid for to encourage faster rollout of full-fibre networks by industry. Children in 100 schools around the country will be some of the first to benefit, starting with a pilot in the East Midlands in early 2018.

- The Budget also commits to specific improvements for the Tyne & Wear Metro, and rail and road connections in the Cambridge – Milton Keynes – Oxford corridor.

- The Budget announces the next steps for the North of Tyne devolution deal, paving the way for the area to elect a Mayor in 2019. This will see £600 million of investment in the region over 30 years and create a new mayor elected in 2019 with powers over planning and skills.

- The government will invest £337 million from the NPIF to replace the Tyne & Wear Metro’s nearly 40-year-old rolling stock with modern energy-efficient trains.

- The government has agreed a second devolution deal in principle with the West Midlands Mayor and Combined Authority to address local productivity barriers. This includes £6 million for a housing delivery taskforce, £5 million for a construction skills training scheme and a £250 million allocation from the Transforming Cities fund to be spent on local intra-city transport priorities.

- The government has agreed a housing deal with Oxfordshire for 100,000 homes by 2031, and is working with Central and Eastern sections on commitments in 2018. The government will also consider significant new settlements and the potential role of development corporations to deliver these using private finance.

- The government will also make available £300,000 to co-fund a study of opportunities for new stations, services and routes across the Oxfordshire rail corridor.

- The government expects authorities and delivery bodies in the Cambridge – Milton Keynes – Oxford corridor to use existing mechanisms of land value capture and the new powers (subject to consultation) announced at the Budget to capture rising land values from the additional public investment. The government will also encourage authorities to explore the introduction of a Strategic Infrastructure Tariff, in addition to the Community Infrastructure Levy (CIL), supported by appropriate governance arrangements. These approaches will require developers to baseline their contributions towards infrastructure into the values they pay for land.

- Greater Manchester and the government will work in partnership to develop a local Industrial Strategy. The government will provide a £243 million allocation from the Transforming Cities Fund and will continue to work with Transport for Greater Manchester to explore options for the future beyond the Fund, including land value capture.

- The government will pilot a manufacturing zone in the East Midlands. This will reduce planning restrictions to allow land to be used more productively, providing certainty for business investment, and boosting local productivity and growth.

- The government will invest in infrastructure upgrades that will provide direct services from Pembroke Dock to London via Carmarthen on new, state of the art Intercity Express trains. Additionally, the Department for Transport continues to develop proposals for a number of potential rail schemes within Wales. This includes station improvements at Cardiff Central Station and Swansea, improving Cardiff to Severn Tunnel Junction Relief Lines, and improving journey times between: Swansea and Cardiff; South Wales, Bristol and London; and on the North Wales Main Line. The government will also consider proposals to improve journey times on the Wrexham – Bidston line and provide necessary funding to develop the business case.

- The government is investing an additional £45 million in the Pothole Fund in 2017/18 to tackle around 900,000 potholes across England.

- The government announces £84 million for digital rail technology, including fitting state-of-the-art in-cab digital signalling across a range of trains. The government is allocating a further £5 million from the NPIF for development funding for a digital railway upgrade on the South East and East London Lines. The government will also fund a digital signalling scheme at Moorgate that will enable more frequent and reliable services.

- The government is announcing a new National Infrastructure Commission study on the future of freight infrastructure, to be published in Spring 2019. The study will look at urban congestion, decarbonisation and how to harness the potential of new technologies. This includes platooning, where trucks travel in convoy using smart technology to communicate.

- An additional £76 million will be spent on flood and coastal defence schemes over the next three years. This funding will better protect 7,500 households and boost food defence investment to over £2.6 billion between 2015/16 and 2020/21. Of this, £40 million will be focussed on deprived communities at high food risk, boosting local regeneration.

- The Budget will provide £5 million to help enable the South Tees Development Corporation to take ownership of the SSI Redcar Steelworks site, and the government will work with local partners to prepare the site for redevelopment.

- Following a consultation earlier this year, the government confirms that it will lend local authorities in England up to £1 billion at a new discounted interest rate of gilts + 60 basis points accessible for three years to support infrastructure projects that are high value for money. Details of the bidding process will be published in December 2017, and corresponding shares will be made available to local authorities in Scotland and Wales.

Capital Funding

- £3.5 billion of new capital funding for the NHS in England: £2.6 billion will be for local groups of NHS organisations (Sustainability and Transformation Partnerships) to deliver transformation schemes that improve their ability to meet demand for local services; £700 million to support turnaround plans in the individual trusts facing the biggest performance challenges, and tackle the most urgent and critical maintenance issues that trusts are facing; and £200 million will support efficiency programmes that will, for example, help reduce NHS spending on energy, and fund technology. This will also be accompanied by private finance investment in the health estate where this provides good value for money.

Taxes and levies

- As previously announced, to ensure that there is enough time to work with Parliament and stakeholders on the detail of reforms that will simplify the National Insurance Contributions (NICs) system, the government has announced that it will delay implementing a series of NICs policies by one year. These include the abolition of Class 2 NICs and reforms to the NICs treatment of termination payments. Also previously announced, the planned increase to the main rate of Class 4 NICs has also been cancelled.

- For business rates, the government will bring forward to 1 April 2018 the planned switch in indexation from RPI to the main measure of inflation (currently CPI).

- Legislating retrospectively to address the so-called “staircase tax” in business rates. Affected businesses will be able to ask the Valuation Office Agency (VOA) to recalculate valuations so that bills are based on previous practice backdated to April 2010 – including those who lost Small Business Rate Relief as a result of the Court judgement. The government will publish draft legislation shortly.

- The frequency with which the VOA revalues non-domestic properties will be moved to revaluations every three years following the next revaluation, currently due in 2022. To enable this, ratepayers will be required to provide regular information to the VOA on who is responsible for business rates and property characteristics including use and rent. The government will consult on the implementation of these changes in the Spring.

- Fuel duty will be frozen for an eighth year in 2018/19. The government will review whether the existing fuel duty rates for alternatives to petrol and diesel are appropriate, ahead of decisions at Budget 2018. In the meantime, the government will end the fuel duty escalator for Liquefied Petroleum Gas (LPG). The LPG rate will be frozen in 2018/19, alongside the main rate of fuel duty.

- The Heavy Goods Vehicle (HGV) VED and Road User Levy rates will be frozen from 1 April 2018. A call for evidence on updating the existing HGV Road User Levy will be launched this autumn. The government will work with industry to update the Levy so that it rewards hauliers that plan their routes efficiently, to encourage the efficient use of roads and improve air quality.

- The government is confident that the Total Carbon Price, currently created by the combination of the EU Emissions Trading System and the Carbon Price Support, is set at the right level, and will continue to target a similar total carbon price until unabated coal is no longer used. This will deliver a stable carbon price while limiting cost on business.

- Budget 2016 announced the rebalancing of gas and electricity main rates; the government will set CCL main rates for the years 2020-21 and 2021-22 at Budget 2018. In addition, and to ensure better consistency between portable fuels for commercial premises not connected to the gas grid, the government will freeze the CCL main rate for LPG at the 2019-20 level until April 2022. To ensure that the CCL exemptions for businesses that operate mineralogical and metallurgical processes remain operable after EU exit, the government will clarify the definition of the exemptions in Finance Bill 2018/19.

- The list of designated energy-saving technologies qualifying for an ECA, which support investment in energy-saving plant or machinery that might otherwise be too expensive, will be updated through Finance Bill 2017/18.

- The government will freeze Aggregates Levy rates for 2018/19 at £2 per tonne but will return to index-linking the Levy in the longer term. Following consultation, the government has decided against introducing an exemption from the Aggregates Levy for aggregates extracted when laying underground utility pipes.

- In response to the Office of Tax Simplification’s report ‘Value Added Tax: Routes to Simplifcation’, the government will consult on the design of the threshold, and in the meantime will maintain it at the current level of £85,000 for two years from April 2018.

- Following a consultation into options for tackling fraud in construction labour supply chains, the government will introduce a VAT domestic reverse charge to prevent VAT losses. This will shift responsibility for paying VAT along the supply chain to remove the opportunity for it to be stolen. Changes will have effect on and after 1 October 2019. The long lead-time reflects responses to the consultation and the government’s commitment to give businesses adequate time to prepare for the change.