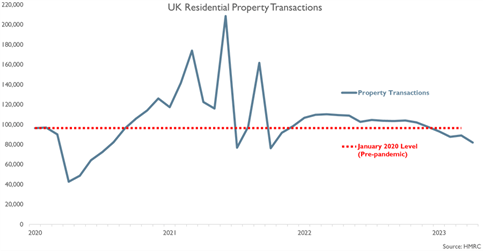

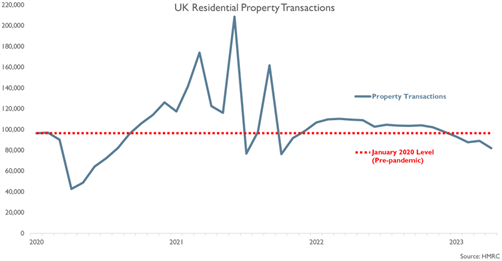

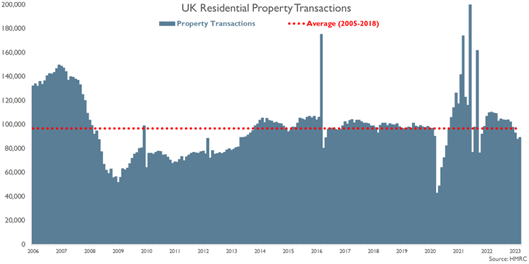

There were 82,120 residential property transactions in the UK in April 2023, which is 7.9% lower than in March & 25.1% lower than a year earlier. Source: HMRC.

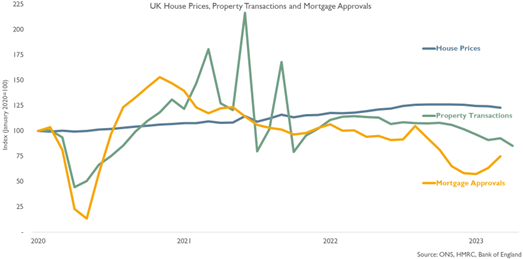

As the sharp fall in mortgage approvals in 2022 Q4 & Q1 continues to feed through & the number of UK residential property transactions in April 2023 was also 14.8% lower than in January 2020, pre-pandemic, before the 'race for space' and stamp duty holidays & whilst Help to Buy was still in place.

The full impact of the fall in mortgage approvals (since the spike in mortgage rates after the government's Mini Budget debacle in Autumn) has still not fed through to property transactions. This is due to the lag between mortgage approvals and transactions, although, property transactions will not fall by as much as mortgage approvals. It is worth noting, whilst mortgage approvals have been rising from the November nadir as mortgage rates have fallen mortgage rates are likely to rise again and consequently, mortgage approvals fall, as additional interest rate rises (additional risk around rate rises) is factored in by lenders.

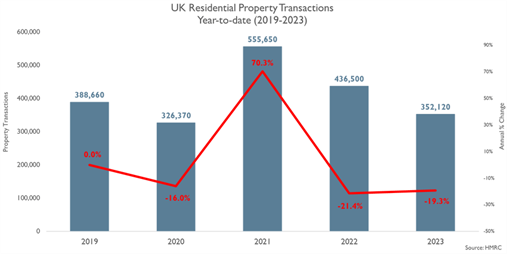

It is still early in the year but year-to-date (January to April), UK residential property transactions in 2023 were 19.3% lower than in 2022 & 9.4% lower than in 2019.

For the longer-term context, property transactions in April 2023 were 15.1% lower than the 2005-2018 average before economic & political uncertainty distortions in 2019 (due to postponed Brexit deadlines & a General Election) & distortions since 2020 affected the housing market.

To keep up-to-date with the latest economic data, you can follow our Economics Director Noble Francis on his Twitter page.

Why not also follow the CPA Twitter page too for the latest movements in the built environment?